Federal Irs Mileage Reimbursement Rate 2021

Federal Irs Mileage Reimbursement Rate 2021. This document gives information within the mileage charges applicable to autos which are employed for company, medical and other functions. What is the current mileage reimbursement rate?

Jun 23, 2021 · per diem rates.

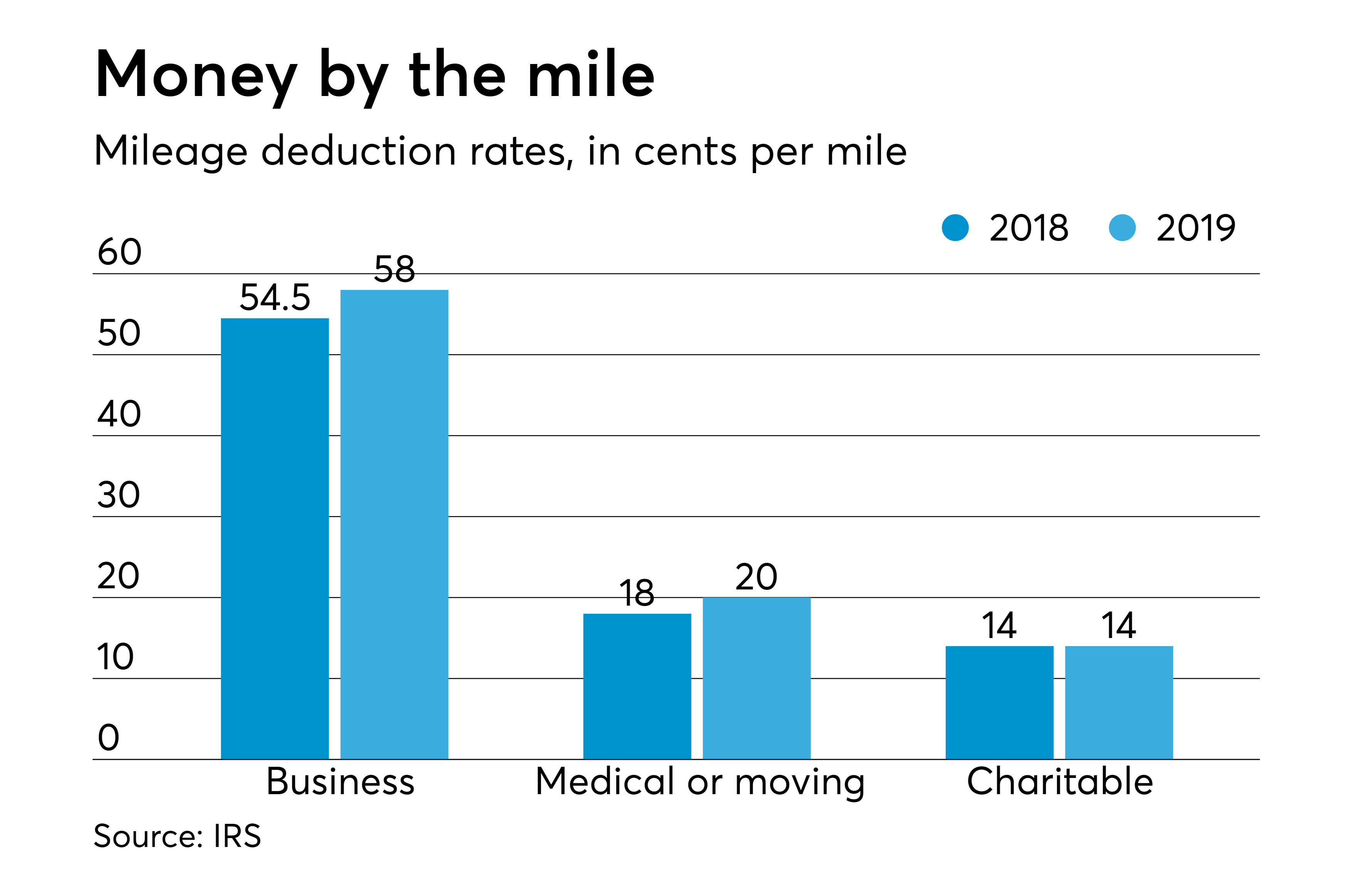

What are the irs mileage reimbursement rules? What is the current us standard mileage rate? 56 cents per mile driven for business use, down 1.5 cents from the rate for 2020, How do you calculate mileage reimbursement rate?

How do you calculate mileage reimbursement rate? Tool to calculate trip allowances. Find current rates in the continental united states (conus rates) by searching below with city and state (or zip code), or by clicking on the map, or use the new per diem. Rates are set by fiscal year, effective october 1 each year.

56 cents per mile driven for business use, down 1.5 cents from the rate for 2020,

2021 federal mileage rates are changing. What is the current mileage reimbursement rate? See full list on irs.gov What are the irs mileage reimbursement rules?

Dec 22, 2020 · beginning on january 1, 2021, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be:

Dec 05, 2020 · the mileage rates are updated by the internal revenue service due to the cost of living adjustment. This document gives information within the mileage charges applicable to autos which are employed for company, medical and other functions. See full list on irs.gov Jun 23, 2021 · per diem rates.

Tool to calculate trip allowances.

See full list on irs.gov The charity mileage rate increase in 2021 is unlikely regardless of the changes to the cost of living. See full list on irs.gov Find current rates in the continental united states (conus rates) by searching below with city and state (or zip code), or by clicking on the map, or use the new per diem.

Rates are set by fiscal year, effective october 1 each year. The irs has announced the standard mileage rate for business purposes in 2020 will be 57.5 cents per mile, down half a cent from 2019. This document gives information within the mileage charges applicable to autos which are employed for company, medical and other functions. What are the irs mileage reimbursement rules?

No comments