Mileage Rate For 2021 Irs

Mileage Rate For 2021 Irs. There are some other recent changes that should be noted by small business owners: Rates in cents per mile.

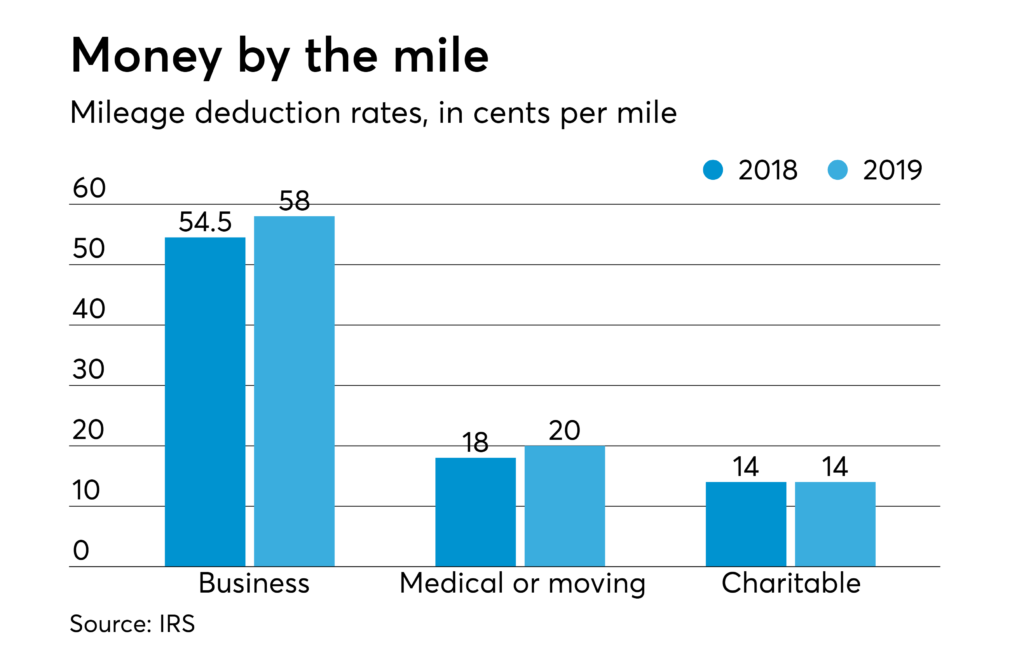

What are the standard mileage deduction rates?

For example, if your vehicle is used only for business, the entire cost of operating it is deductible. There are some other important distinctions. There are some other recent changes that should be noted by small business owners: See section 4.04 of rev.

Small business can find other limitations in section 4.05 of rev. See full list on msn.com See full list on msn.com What is the current government mileage rate?

A moving expense deduction has also been eliminated.

Apr 09, 2021 · the 2021 irs mileage rate for business purposes is 56 cents per mile—the highest of the mileage rates. What is the current mileage reimbursement rate? The business standard mileage rate doesn’t apply to over five vehicles that are being used at the same time. A moving expense deduction has also been eliminated.

A moving expense deduction has also been eliminated.

For taxpayers who use their vehicles for business, actual costs are an alternate method to claim deductions. In fact, there are some instances where the standard mileage rate is not allowed. If you use a vehicle for personal and business purposes, only the part that’s used for business can be deducted. Records need to be kept for all deductions.

There are some other recent changes that should be noted by small business owners:

Small businesses who decide to use the standard mileage rate need to implement it in the first year the vehicle is used for business. Under the tax cuts and jobs act, taxpayers will not be allowed an unreimbursed employee travel expense deduction. There are some other important distinctions. For example, if your vehicle is used only for business, the entire cost of operating it is deductible.

There are some other important distinctions. Keeping detailed records helps you keep track of all of your deductible expenses. What are the standard mileage deduction rates? More news for mileage rate for 2021 irs »

No comments