State Of Ct Mileage Rate 2021

State Of Ct Mileage Rate 2021. If you do not use the state mileage chart, a copy of the document (map quest or rand mcnally) that. Standard mileage rates for the use of a car (also vans, pickups or panel trucks).

Starting on january 1, 2021, the standard mileage rates for the use of a car, van, pickup, or panel truck will be:

The mileage rate for the 2021 tax year is $0.56 per mile driven. Irs fixes the standard mileage rate for business on the basis of an annual study of the fixed and variable costs of operating an automobile, whereas the mileage rates for medical and moving. Irs mileage rates » 2021. It simplifies tracking by automatically using the correct irs standard mileage rates based on the date of your trip.

Schedule of expenditures of federal awards (sefa). See rates to calculate deductions and reimbursements for business. Understanding the 2021 standard mileage rate. The medical & moving rate is based on variable costs of operation.

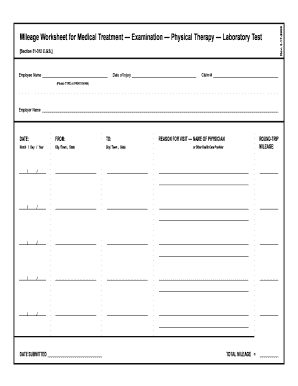

Effective january 1, 2021, the standard mileage reimbursement rate for transportation expenses as set by the internal this rate should be used by workers' compensation carriers for reimbursement for eligible workers' compensation travel expenses incurred on or after january 1, 2021.

How will the rate change, and more importantly, how will it impact your business? As of january 1, 2021, you will be able to deduct 56 cents per mile on your taxes for your business mileage. The pandemic continues in the united states, with many indicators suggesting business activity might not recover to. This is something to take into consideration while you track your expenses throughout 2021.

For 2021 tax returns, you can deduct expenses that relate to your work as an employee if any of the following apply to you:

It simplifies tracking by automatically using the correct irs standard mileage rates based on the date of your trip. Irs mileage rates » 2021. Here is a list of our partners. For 2021, the business standard mileage rate is 56 cents per mile (a 1.5 cent.

Don't like reading tax mumbo jumbo?

For 2021, standard mileage rates for the use of cars, vans, pickups or panel trucks will be: 56 cents per mile driven for business use, down 1.5 cents from the standard mileage rate for business use is based on an annual study of the fixed and variable costs of operating an automobile. The 2021 irs standard mileage rate is 56 cents per mile for every business mile driven,14 cents per mile for charity and 16 cents per mile for moving or medical. If you're an employer in the united states, it's likely that you pay your employees mileage reimbursement when they're traveling for work purposes.

The rates for medical and moving dropped to 16 cents per mile, while the rate for miles driven in service of charitable organizations remains the. 56 cents per mile for business use. Effective january 1, 2021, the mileage rate is 56 cents per mile. It simplifies tracking by automatically using the correct irs standard mileage rates based on the date of your trip.

No comments