Texas State Mileage Rate 2021

Texas State Mileage Rate 2021. For areas not listed, the daily rates are: What is the current mileage reimbursement rate?

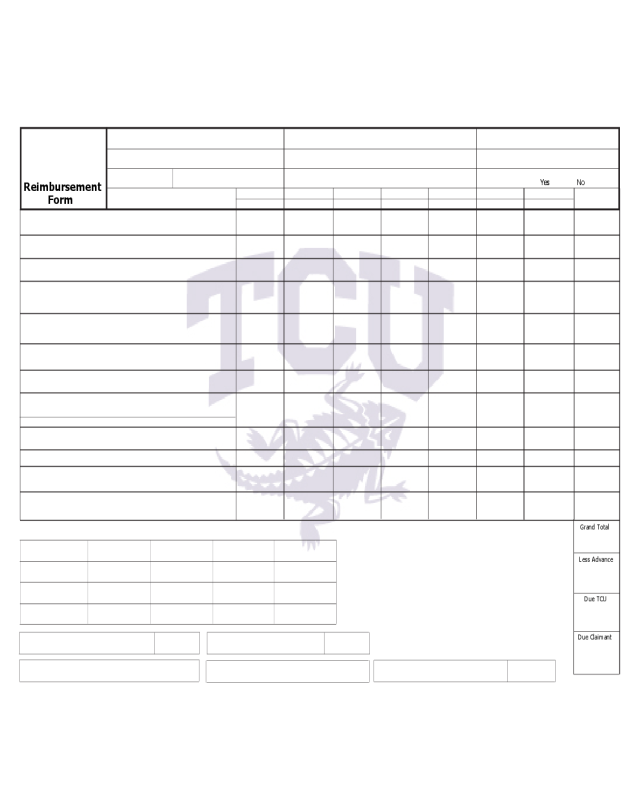

May 06, 2005 · texas state’s maximum mileage reimbursement rate for travel occurring on or after january 1, 2021 is 56 cents per mile.

Jan 01, 2021 · the texas comptroller of public accounts has published the travel and mileage reimbursement rates effective as of january 1, 2021, as summarized below: What is the current irs mileage rate? May 06, 2005 · texas state’s maximum mileage reimbursement rate for travel occurring on or after january 1, 2021 is 56 cents per mile. 56 cents per mile (jan.

56 cents per mile (jan. General appropriations act, article ix, part 5. Jan 01, 2021 · the texas comptroller of public accounts has published the travel and mileage reimbursement rates effective as of january 1, 2021, as summarized below: The automobile mileage reimbursement rate is 56 cents per mile.

56 cents per mile driven for business use, down 1.5 cents from the rate for 2020,

If an employee operates his or her personal vehicle for the. The texas comptroller of public accounts has published the travel and mileage reimbursement rates effective as of january 1, 2021, as summarized below: The automobile mileage reimbursement rate is 56 cents per mile. The meal reimbursement rate for overnight travel is listed by city on the federal per diem rate map.

Dec 22, 2020 · beginning on january 1, 2021, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be:

The automobile mileage reimbursement rate is 56 cents per mile. Effective january 1, 2021 through december 31, 2021, the maximum mileage reimbursement rate has been reduced to.56/mile, by the irs. 56 cents per mile driven for business use, down 1.5 cents from the rate for 2020, What is the current mileage reimbursement rate?

May 06, 2005 · texas state’s maximum mileage reimbursement rate for travel occurring on or after january 1, 2021 is 56 cents per mile.

General appropriations act, article ix, part 5. What is the mileage reimbursement rate in texas? Oct 01, 2020 · up to twice the amount listed on gsa’s domestic maximum per diem rates. What is the current irs mileage rate?

Oct 01, 2020 · up to twice the amount listed on gsa’s domestic maximum per diem rates. What is the current mileage reimbursement rate? If an employee operates his or her personal vehicle for the. The automobile mileage reimbursement rate is 56 cents per mile.

No comments