2021 Mileage Reimbursement Rate Calculator

2021 Mileage Reimbursement Rate Calculator. Stay organized for tax time! The irs hasn't released the 2021 mileage rates at the time of writing this.

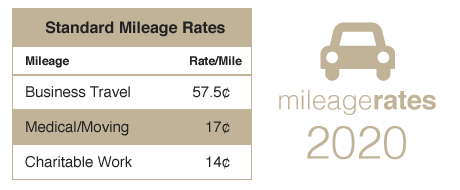

2021 mileage reimbursement calculator is based on just announced optional standard mileage rates for calculating the deductible costs of operating a motor vehicle for business, charity or for medical purposes.

If you are using a personal vehicle for business, medical or charitable purposes, you may find it useful to find your irs mileage reimbursement. The mileage reimbursement rates for official travel via privately owned vehicle decreased in 2021. In conjunction with the coronavirus university restart team (curt) travel. 57.5 cents per mile for business miles driven, down from 58 cents in 2019.

Handle you mileage reimbursement with the rates for 2021 and 2020. For pcs travel the mileage allowance in lieu of transportation (malt) rate is $0.16 per mile, down from $0.17 per mile. Before we show you the fairly straight forward calculation that will help you find your mileage reimbursement, be aware that you need to qualify to use the irs's standard mileage rate. If you can prove that your road expenses are eligible based on the criteria issued by the irs, you can make deductions on the.

Mileage reimbursement calculator | mileage compensation.

Standard mileage rates 2021, 2022. Mileage reimbursement how mileage reimbursement works in. Gsa has adjusted all pov mileage reimbursement rates effective january 1, 2021. 2021 optional standard irs mileage rates are used to calculate the deductible costs of operating an automobile for business, charitable, medical or if an employee can show that the chosen mileage reimbursement rate, even the irs rate, does not cover all actual expenses the employee has.

Gsa / irs mileage reimbursement rates.

The mileage reimbursement rates for official travel via privately owned vehicle decreased in 2021. Stay organized for tax time! Guide to 2021 irs mileage rates quickbooks. Annual mileage reimbursement costs based on the numbers you provided.

Business expense and travel reimbursements (betr).

Charity mileage rate 2021— the irs allows employees of the private companies to make reimbursement on miles driven for business, medical, charitable purposes. The irs hasn't released the 2021 mileage rates at the time of writing this. Current mileage reimbursement rate 2021show all. The 2020 mileage rate was 57.5 cents per mile (.575).

Handle you mileage reimbursement with the rates for 2021 and 2020. Gsa has adjusted all pov mileage reimbursement rates effective january 1, 2021. Round to the nearest mile. Before we show you the fairly straight forward calculation that will help you find your mileage reimbursement, be aware that you need to qualify to use the irs's standard mileage rate.

No comments