Government Mileage Rate 2021 Uk

Government Mileage Rate 2021 Uk. Jul 04, 2019 · the attached document is classified by hmrc as guidance and contains information about rates and allowances for travel including mileage and fuel allowances. Jul 21, 2020 · the advisory electricity rate for fully electric cars is 4 pence per mile.

The advisory fuel rates for petrol, lpg.

What are the irs mileage reimbursement rules? Hybrid cars are treated as either petrol or diesel cars for advisory fuel rates. The advisory fuel rates for petrol, lpg. Information has been updated to.

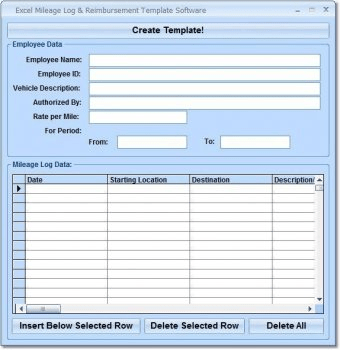

This document provides info on the mileage charges applicable to autos which can be used for business, medical and other functions. Jul 28, 2021 · gsa has adjusted all pov mileage reimbursement rates effective january 1, 2021. What are the irs mileage reimbursement rules? If you travel 17,000 business miles in your car, the mileage deduction for the year would be £6,250 (10,000 miles x 45p + 7,000 miles x 25p).

This makes calculating business mileage fairly simple.

Jul 28, 2021 · gsa has adjusted all pov mileage reimbursement rates effective january 1, 2021. You just need to multiply the miles you travelled by the specific mileage rate for your vehicle. It does not matter if. From tax year 2011 to 2012 onwards first 10,000 business miles in the tax year each business mile over 10,000 in the tax year;

What is the standard mileage rate?

This document provides info on the mileage charges applicable to autos which can be used for business, medical and other functions. It does not matter if. Information has been updated to. What are the irs mileage reimbursement rules?

If you travel 17,000 business miles in your car, the mileage deduction for the year would be £6,250 (10,000 miles x 45p + 7,000 miles x 25p).

If you travel 17,000 business miles in your car, the mileage deduction for the year would be £6,250 (10,000 miles x 45p + 7,000 miles x 25p). Apr 27, 2021 · as a result, the current amap rates are 45p per mile for the first 10,000 miles and 25p per mile thereafter. You just need to multiply the miles you travelled by the specific mileage rate for your vehicle. What is the standard mileage rate?

Jul 28, 2021 · gsa has adjusted all pov mileage reimbursement rates effective january 1, 2021. The advisory fuel rates for petrol, lpg. Jul 28, 2021 · gsa has adjusted all pov mileage reimbursement rates effective january 1, 2021. What is the irs mileage reimbursement?

No comments